The global oil market finds itself navigating uncertain waters as U.S. policies and broader geopolitical developments continue to shape its trajectory. At the center of this uncertainty is the impact of proposed tariffs by President Trump, which could fundamentally alter the supply and demand dynamics of oil in both domestic and international markets.

Click for concise version

The Tariff Effect: A Double-Edged Sword

President Trump’s proposed tariffs on imports from Canada, Mexico, and other nations promise to shake the oil market to its core. These policies, aimed at addressing trade imbalances, may inadvertently raise U.S. gasoline prices by $0.25 to $0.75 per gallon due to retaliatory measures and increased production costs. The uncertainty surrounding these measures has already begun to influence crude oil prices, with analysts warning of fluctuations and volatility.

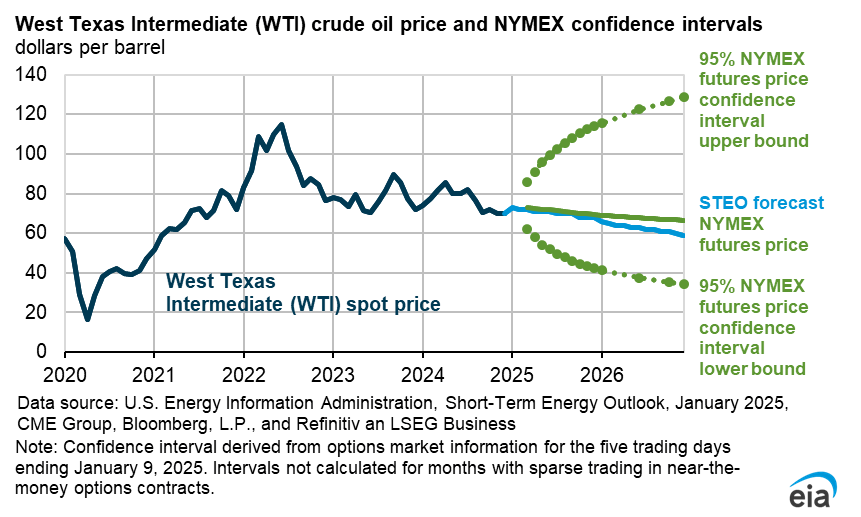

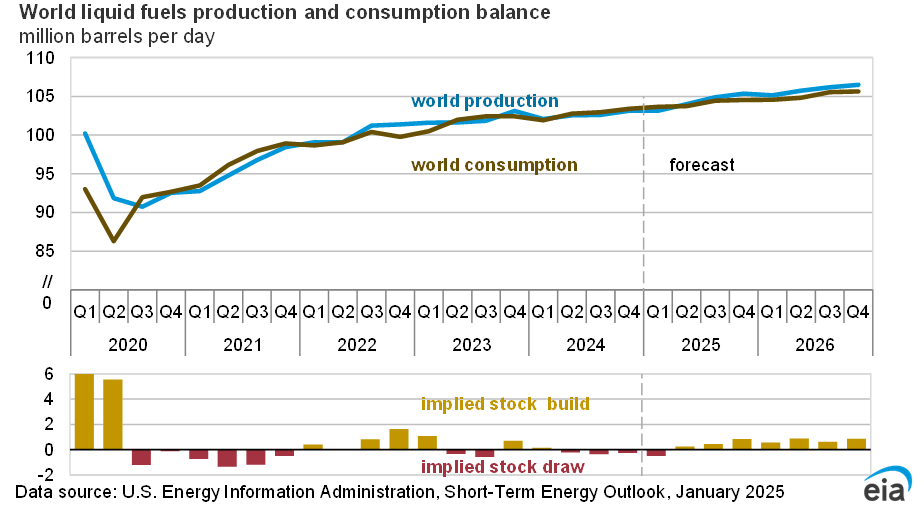

Globally, the ripple effect of these tariffs could create supply disruptions while dampening demand growth. WTI crude oil, trading around $75 per barrel, remains under pressure as markets grapple with these evolving challenges. While increased U.S. production could offset some of the adverse effects, the broader economic implications suggest a prolonged period of instability.

Price Trends: Mixed Signals in a Volatile Market

WTI crude oil currently hovers at $75 per barrel, constrained by competing market forces. On the one hand, easing geopolitical tensions in regions like Gaza have tempered fears of supply disruptions. On the other, growing U.S. crude stockpiles exert downward pressure.

Key price levels provide a glimpse into the market’s short-term trajectory:

Support: Prices find buyers around the $70-$72 range, a critical level that has historically signaled a rebound.

Resistance: Selling pressure is evident at the $78-$80 zone, keeping prices from breaking out.

Technically, the market remains at a crossroads. The infamous “death cross,” where the 50-day exponential moving average (EMA) remains below the 200-day moving average, underscores the bearish sentiment. Yet, indicators like Bollinger Bands and the Relative Strength Index (RSI) suggest pockets of optimism, pointing to potential bounce zones around $75-$76. The MACD, meanwhile, offers a glimmer of bullish hope, reflecting underlying momentum.

Inventory Builds and the Supply Conundrum

The U.S. oil inventory picture reveals a steady increase in crude and refined products, signaling robust supply. In the week ending January 17:

Crude stocks rose by 958,000 barrels.

Gasoline inventories surged by 3.23 million barrels.

Distillate stocks increased by 1.88 million barrels.

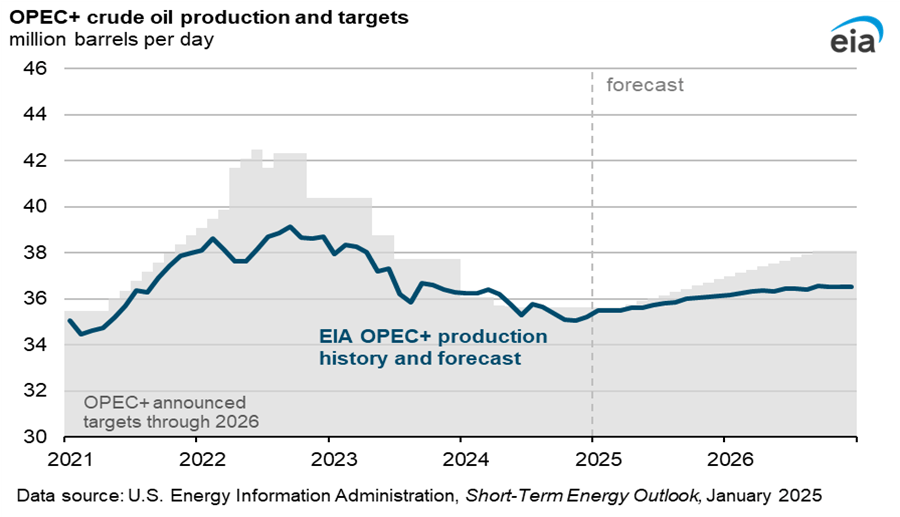

These builds further reinforce the downward pressure on oil prices, particularly as U.S. energy policies prioritize ramping up domestic production. President Trump’s energy emergency declaration, which aims to streamline infrastructure development and ease environmental restrictions, is expected to support higher output levels in the near term.

Market Sentiment: Balancing Hope and Fear

Market analysts describe the current environment as one driven by mixed signals. The optimism stemming from potential production increases and geopolitical stability is counterbalanced by lingering fears of reduced demand growth. Trump’s tariff threats against major trading partners, including Canada, Mexico, and the European Union, add another layer of complexity, creating an atmosphere of cautious pessimism.

For traders, the near-term outlook remains challenging. Price volatility is expected to persist, with a potential dip to $71 as the market seeks liquidity before finding support for an upward trend. Our analysis recommends a cautious approach, focusing on selling zones in the $76.20-$77.70 range.

The Bigger Picture: Risks and Opportunities Ahead

As the oil market braces for more turbulence, the key risks revolve around U.S. trade policies and global economic uncertainty. Trump’s aggressive stance on tariffs, coupled with the possibility of further sanctions, introduces an unpredictable element to the equation. At the same time, increased U.S. production provides a buffer, offering hope for a more balanced market in the long run.

The story of oil, as it unfolds in 2025, is one of resilience amidst adversity. With shifting policies and fluctuating prices, the market’s future hinges on the delicate interplay of domestic production, global demand, and the ever-present spectre of political intervention. For now, traders and analysts alike must navigate these complexities with caution, keeping an eye on both the risks and opportunities that lie ahead.

US Oil Market Update Summary January 23rd

Impact of Trump’s Tariffs on Oil Prices

Domestic Impact: Proposed tariffs on Canada, Mexico, and other trade partners could increase U.S. gasoline prices by $0.25 to $0.75 per gallon due to retaliation and higher production costs. These policies create volatility in crude oil prices, affecting both supply and demand.

Global Impact: Global oil prices, particularly WTI crude (currently around $75/barrel), are pressured by uncertainty about the tariffs, leading to potential supply disruptions and dampened demand growth.

Current Price Trends

- WTI Crude Oil: Trading around $75 per barrel as of January 23.

- Key Levels:

- Support: $70-$72 (areas of prior buying interest).

- Resistance: $78-$80 (areas of selling pressure).

- Technical Indicators:

- Moving Averages: The “death cross” (50-day EMA below 200-day MA) suggests bearish sentiment.

- Bollinger Bands: Price is above the middle band, showing potential short-term bullishness.

- RSI: Around 54-59, indicating $75-$76 as a bounce zone.

- MACD: Daily view remains bullish.

Market Drivers

- Mixed Market Factors:

- Positive: Easing geopolitical risks in Gaza and potential U.S. production increases under pro-drilling policies.

- Negative: Higher U.S. crude stocks and gasoline inventories, with stock levels rising as follows:

- Crude: +958,000 barrels (week ended Jan 17).

- Gasoline: +3.23 million barrels.

- Distillates: +1.88 million barrels.

- Uncertainty: Lack of clarity on Trump’s tariff policies and increased U.S. oil supplies could cause near-term volatility and downward price movements.

Outlook

Short-term bearish outlook remains dominant due to mixed technical and fundamental factors. Prices may drop to $71 to seek liquidity before resuming an upward trend. Selling zones are identified at $76.20-$77.70.

Key Risks

Ongoing trade uncertainties from Trump’s policies, potential new tariffs, and global economic slowdowns could weigh heavily on oil market stability.

Thus, oil prices and market trends remain heavily influenced by U.S. trade policies, reflecting the ongoing bearish sentiment in the market.

Bitcoin breaks $100K

brent oil

BTCUSD

ceasefire

CL_F

CPI data

crude oil

Cryptocurrency market performance

day trading

Dollar strength

DXY

FED

Forex analysis

Forex market analysis

geo-politics

GOLD

Gold price surge January 2025

Inflation impact on markets

Israel-Hamas

macro investing

macro market newsletter

macro markets

macro report

macro trading

market analysis

Market trends January 2025

market volatility

Middle East

Oil price volatility

OPEC

technical analysis

trading strategies

treasury yields

Trump tariffs

U.S. stock market rally

UK Gilts

USDJPY

US inflation

US Oil

USOIL

VIX

Weekly market recap

WTI

XAUUSD

XTIUSD