The following is a brief summary and takeaway of the EIA (Energy Information Administration) Short-Term Energy Outlook (STEO) January publication.

Outlook for Oil Prices:

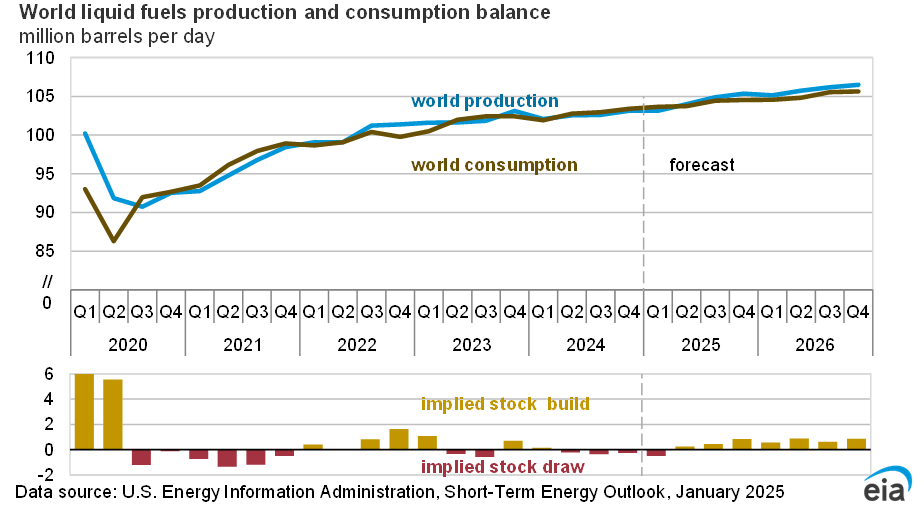

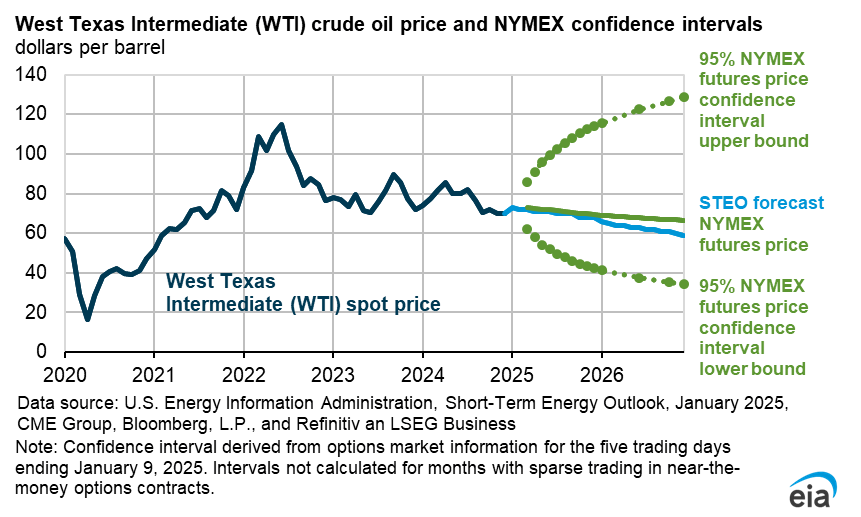

- Near-term (2025): Prices may remain stable or decline slightly after Q1 2025 due to stock builds and slower demand growth.

- Mid-term (2026): Brent oil prices are forecasted to drop significantly, driven by oversupply and reduced growth in global demand, especially from OECD countries.

Reasons for OPEC Actions:

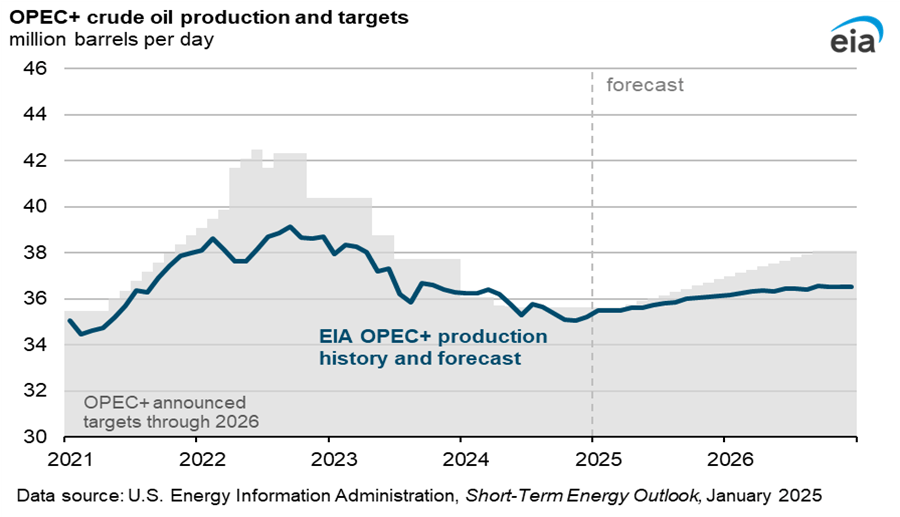

- Stabilizing market share: OPEC+ is increasing output incrementally to meet anticipated demand growth while maintaining influence over prices.

- Balancing commitments and capacity: Despite higher output, production will likely fall short of announced targets due to internal constraints and deliberate measures to prevent excessive price declines.

- Strategic responses to competition: OPEC’s actions reflect an effort to remain competitive against non-OPEC producers like Brazil, Canada, and Guyana, which are contributing significantly to global supply growth.

Takeaway:

- Global oil production is projected to grow moderately: OPEC+ production is expected to rise annually, though not to the full extent of announced targets. Non-OPEC+ nations will also see steady increases, driven by Brazil, Canada, and Guyana.

- Market balance pressures: While output grows, Brent oil prices are expected to drop after Q1 2025 due to stock builds and reduced OECD demand growth in 2026.

- US oil output nearing a plateau: Growth in tight oil regions like the Permian Basin is barely offsetting declines elsewhere, leading to marginal increases by 2026.